Combining technology with financial services in the age of mobile, cloud and blockchain gives rise to many potential disruptors and established players trying to increase, protect, license and monetize their intellectual property. I explore some of these ideas in my recent article in Slaw on Protecting FinTech Innovation.

The article was published today in Slaw and is reproduced below:

“FinTech”, the combination of technology and financial services is taking off with numerous startups and established players all trying to optimize, expand and disrupt the industry. The increasing use of mobile technology, cloud services and changing regulations is causing rapid change in the way services are being provided in many areas, including for financial services. Examples including new payment methods, mobile apps, lending and funding systems, such as crowdsourcing platforms, cloud based budgeting, accounting and finance software, and back office processing.

For companies innovating in this space, there are several types of protection being employed to try to maintain a competitive edge. Identifying the proprietary intellectual property is important, particularly for companies entering into agreements or licenses with others to co-develop, market or distribute their products or services.

Trade Secrets

For services that rely on algorithms or methods to provide the services, particularly if implemented on servers under the control of the operator, keeping the algorithm confidential may be an effective way to keep prying eyes from copying the design.

Clearly, in order to maintain the design confidential, the ‘magic’ of the algorithms must not be discernible from users of the system. Sophisticated matching, neutral network or other AI algorithms might be suitable for protection in this way.

Patents

Many companies are applying for and obtaining patent protection for various aspects of their technology. A granted patent provides the right to exclude others from practicing the claimed invention.

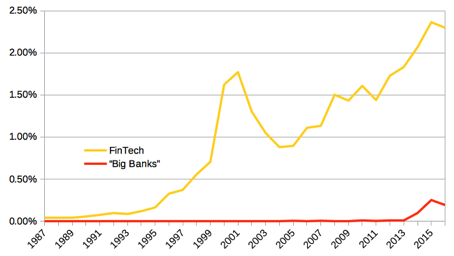

Below is a chart of the number of patents applied for in the ‘FinTech’ space in Canada as a percentage of all applications files each year. This captures applications classified as G06Q 20 to 40 relating payment architectures, e-commerce and finance. Also shown is the number of these patent applications being filed by the Canadian ‘big five’ banks in the same class.

This shows the rapid growth in patent filings in this area, including a bump in the ‘dot-com’ era in the early 2000. The percentage of FinTech patent filings has more than doubled from less than 1% of all filings in 2004 to almost 2.5% of all filings in 2015.

Obtaining patents for financial services related technology can be difficult because of limits on what is patentable subject matter. Patent offices in many countries, including Canada, require that patents are not merely ‘abstract’ methods but have some practical application.

In Canada, the Federal Court of Appeal reviewed Amazon.com’s “one-click” patent application (see 2011 FCA 328) and considered that a patent application where the single point of novelty was a new algorithm or mathematical formula was not patentable subject matter but did not foreclose the patenting of ‘business methods’. The Amazon.com patent was granted by the patent office shortly after the decision and the Canadian patent office issued guidelines on what was considered patentable in Canada.

More recently, the Patent Appeal Board, the internal tribunal that hears appeals from patent examiners at the Canadian Patent Office, considered the patentability of Alice Corporation’s patent application relating multi party risk management contracts. This patent application is particularly noteworthy because the patentability of the corresponding United States patent was litigated to the United States Supreme Court and found unpatenable. In the Patent Appeal Board decision (see PAB1408 released in August 2016), the Canadian Patent, No. 2,163,768 was found to be also unpatentable following the jurisprudence of the Federal Court of Appeal and the patent office’s own guidelines.

As the graph above shows, the patent office’s position on the patentability of financial related patent applications has not slowed the filing of applications in this space. Often, it takes years for the applications to work through the patent office to either an allowance or a rejection. In the case of Alice Corporation’s patent application at issue before the Patent Appeal Board, it had actually expired prior to the board’s decision. Approximately 250 patents have been granted in 2016 with a FinTech classification, almost double the number from 2015 and almost triple the number of granted patents in 2013.

The graph also shows the recent increase in filings by the big banks in the FinTech space suggesting that it isn’t only the “disruptors” seeking to innovate and protect their ideas relating to financial services technology.

Data

Another type of protection that companies are attempting to use is in the data itself that is collected or obtained through the financial services. Often the data itself is the most valuable aspect of the service because it can provide better targeting and personalizing of services or can event be sold to others.

Carefully complying with personal privacy regulations and while protecting against cybersecurity attacks, companies can collection transaction, location and individual preference information from users. This information can be used to provide personalized services based on the user’s location or past practices and predictive algorithms can be used to guess the future behaviour of the users.

This data may be kept highly confidential and may be additionally protected through sui generis database rights available in some jurisdictions.

What happens next?

With the continued development of the technology and greater acceptance by the public, the impact of technology on financial services will continue to grow. A number of regulators are reviewing or modifying their rules to make it easier for new players to enter the market. For example, in September 2016, the Ontario Securities Commission introduced LaunchPad to provide a ‘modern approach’ to security regulations for FinTech businesses and in May 2016, the Competition Bureau launched a FinTech market study to review, among other things, how innovation is affecting the way consumers and businesses use financial products and .services.

As at least some of the patent applications currently in the system, are granted, some players may establish themselves as dominate in certain spaces or establish key technology that is either licensed to others or unique to a single provider. Each company should examine its intellectual property protection to see how its intellectual property fits within its business plans and growth strategy. It is an exciting and interesting time to be involved in technology and financial services.